Personal Income Tax

According to the Singapore Income Tax Act, all income earned by individuals working, doing business and investing in Singapore is subject to income tax, unless they are exempted in the Income Tax Act. Individuals who do not work but have income are specially exempted from investment income, military service allowances, part-time income, royalties and pensions.

Taxable income

- Employment income Business and trade income Investment income

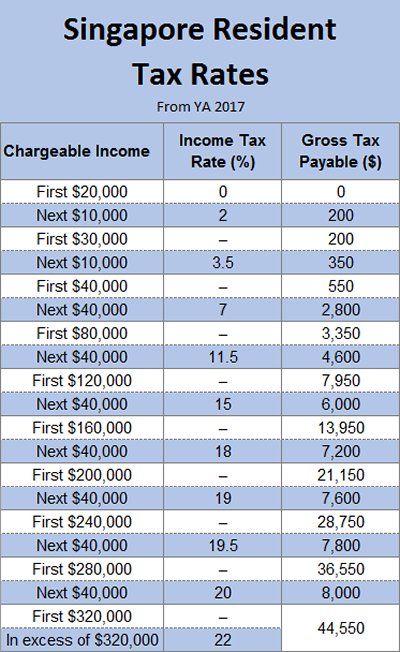

Personal income tax rate

Singapore’s personal income tax rate depends on residency status. If you are a Singapore citizen or permanent resident but are temporarily absent from Singapore, or a foreigner who has worked in Singapore for less than 183 days, you will not be considered a Singapore resident and therefore do not have to pay tax.