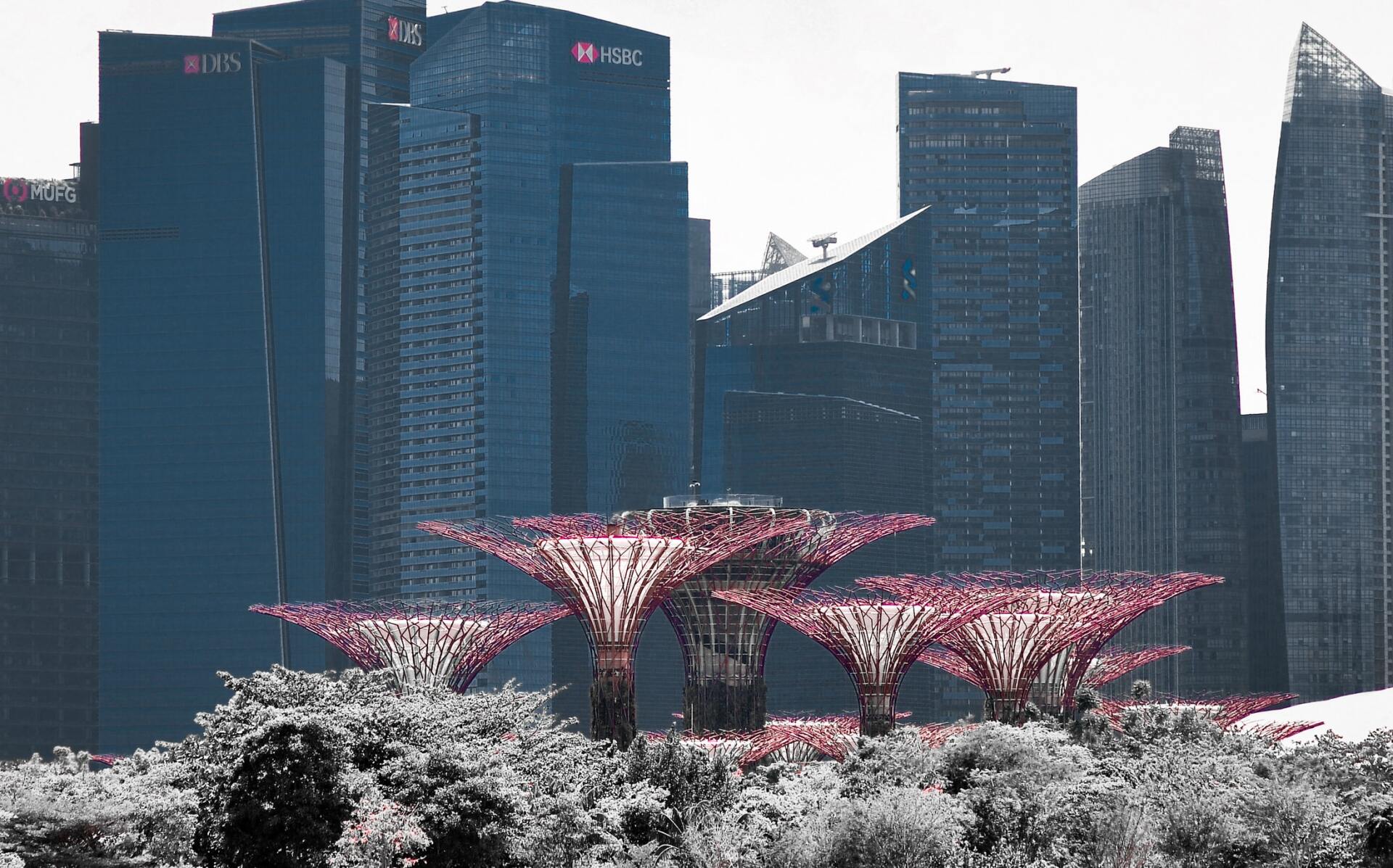

Bank of Singapore

Singapore is renowned as an international financial center, providing services to the entire Asia-Pacific region as well as the local economy. The banking industry in Singapore plays a very key role and has rapidly developed into one of the most powerful industries in the world. Singapore has achieved today's success due to a very sound political environment and economy, very business-friendly legal and tax policies, clean and strict law enforcement against crime and money laundering activities, etc. Today, there are as many as 117 foreign banks and 6 local banks dominating the banking industry.

What drives the success of Singapore's banking industry?

- Opening up the local banking market Local banks have greatly strengthened their regional banking business through mergers and acquisitions The gradual growth of foreign banks in Singapore has enabled Singapore to become an important banking service and stand on a global platform, thus greatly improving its competitiveness Increasingly fierce competition has stimulated the development of innovative products and more competitive pricing models In addition to traditional business models such as lending and deposits, banks also provide comprehensive banking services such as corporate and investment banking Strict banking secrecy laws, Singapore's tax incentives and a range of wealth and asset management services have led to the prosperity of the private banking industry. In order to cater to the new needs of Asians and Europeans, Swiss giants Credit Suisse Group and UBS AG have expanded their private banking business in Singapore Understanding and meeting the needs of small and medium-sized enterprises that make up the banking market in Singapore

Major local banks in Singapore

- DBS OCBC UOB

Major foreign banks in Singapore

- HSBC Standard Chartered ABN-AMRO Bank of Singapore Maybank BNP Paribas Citibank