Deregistration of a company

If you do not want to continue to operate your company in Singapore, you can notify the Singapore Accounting and Corporate Regulatory Authority (ACRA) to delete the company name. The whole process is called deregistering the company, which is called striking off in English.

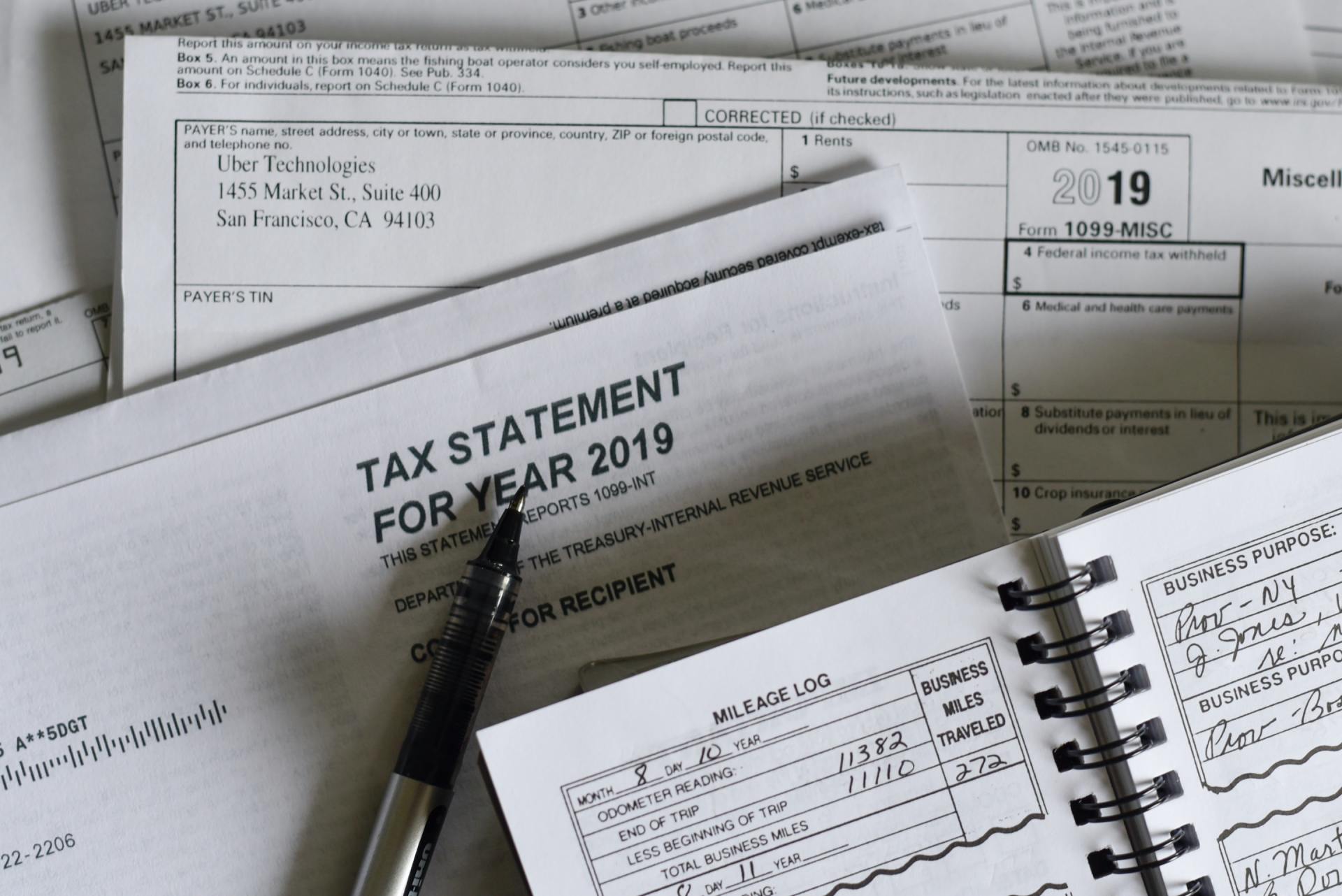

First, pay any outstanding taxes

Any company registered in Singapore must pay off all outstanding taxes before deregistration, otherwise the Inland Revenue Authority of Singapore (IRAS) will oppose the company's deregistration application.

Second, submit any unfiled tax returns

The tax return form is Form C or CS (Form C/CS). The company must ensure that all overdue tax returns are fully submitted before deregistration. Companies that submit Form C must also submit company financial reports and tax calculations before the end of their operations.

The Singapore Inland Revenue Authority will usually complete the assessment within one month. For companies that submit incomplete information or companies with complex affairs, the Singapore Inland Revenue Authority will conduct further investigations, which may take up to half a year or more.

How to check tax liability

The Singapore Inland Revenue Authority of Singapore’s website, Mytax Portal, and 24-hour toll-free hotline are your best bet for inquiries.

Dormant Company

For dormant companies, they can apply for tax exemption as dormant companies. However, please note that the Singapore Inland Revenue Authority will not provide tax clearance certificates. Companies can determine whether the company owes taxes through the latest tax assessment notice and the latest account statement of tax liabilities.

Deregistration of a Singapore Company by a Foreign Company

Singapore Company Law requires foreign companies to submit a notice to the Singapore Accounting and Corporate Regulatory Authority (ACRA) within 7 days of ceasing operations of a Singapore branch. Like other local companies, the company must submit all relevant documents and pay all outstanding taxes. The Singapore Inland Revenue Authority usually completes the assessment within one month. For companies that submit incomplete information or companies with complex affairs, the Singapore Inland Revenue Authority will conduct further investigations, which may take up to half a year or more.