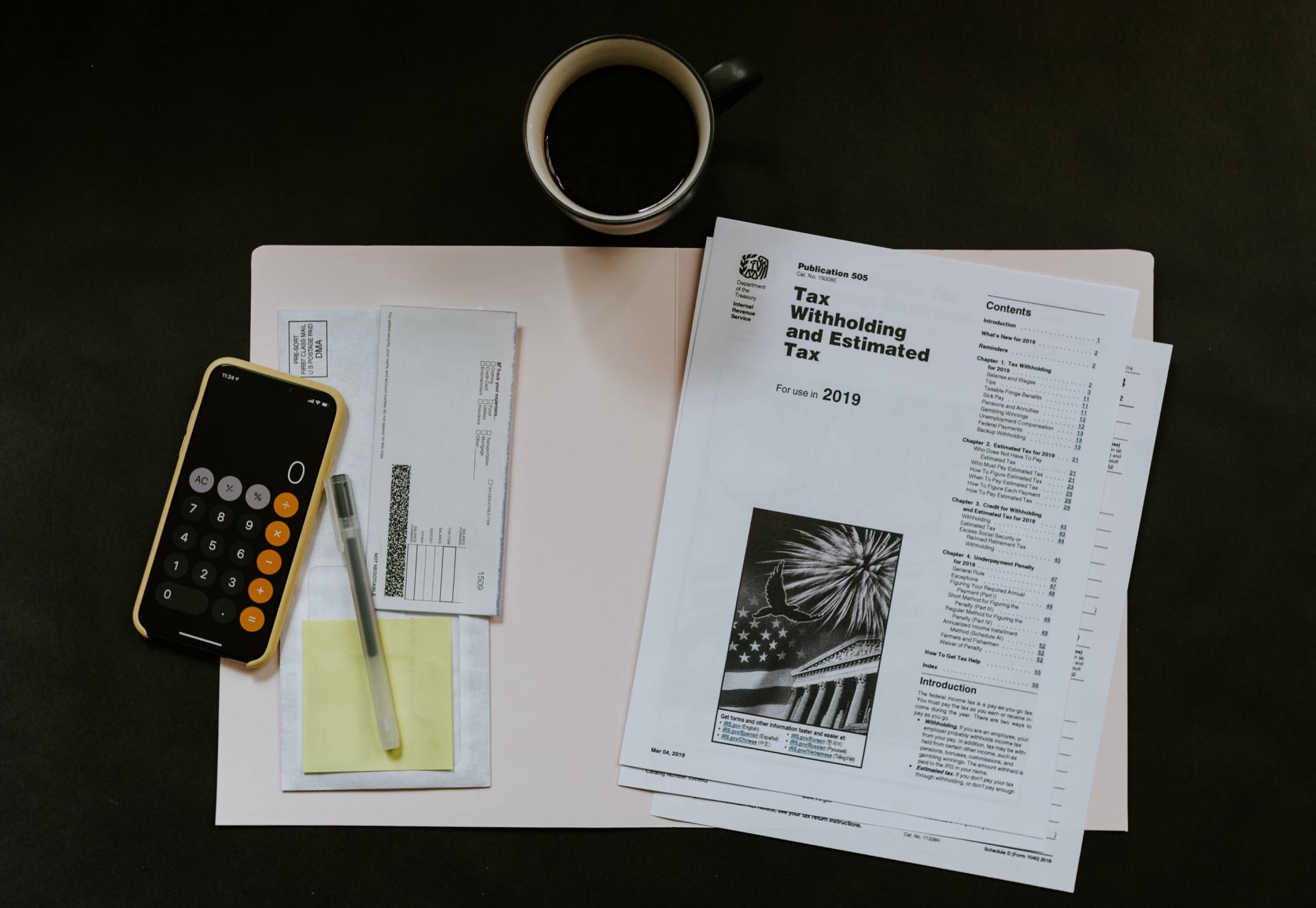

corporate income tax

Singapore has a flat tax rate of 17% and all local companies are required to file a tax return. Examples of the basis period and year for assessing tax in Singapore are as follows:

| Financial year end date | Base period | Year of Assessment (YA) |

|---|---|---|

| March 31st of every year | April 1, 2019 – March 31, 2020 | 2021 |

| June 30th of every year | July 1, 2019 - June 30, 2020 | 2021 |

| December 31st of every year | January 1, 2020 – December 31, 2020 | 2021 |

Taxable income includes

- Income and profit from any company's operations; investment income such as interest, dividends and real estate rentals; franchise income, insurance premium income and other property profits; other income that is considered income

However, Singapore companies can deduct government grants to reduce their tax payable.

Deductible business expenses

In simple terms, deductible operating expenses are all “expenses used entirely to produce income” and the following qualify:

- Expenses are incurred to produce income. Expenses must be incurred for capital. Expenses are not considered expenses. Expenses that are not prohibited from being deducted under income tax law.

Nondeductible business expenses

Simply put, as long as it does not meet the requirements of "deductible business expenses", it is a non-deductible business expense.

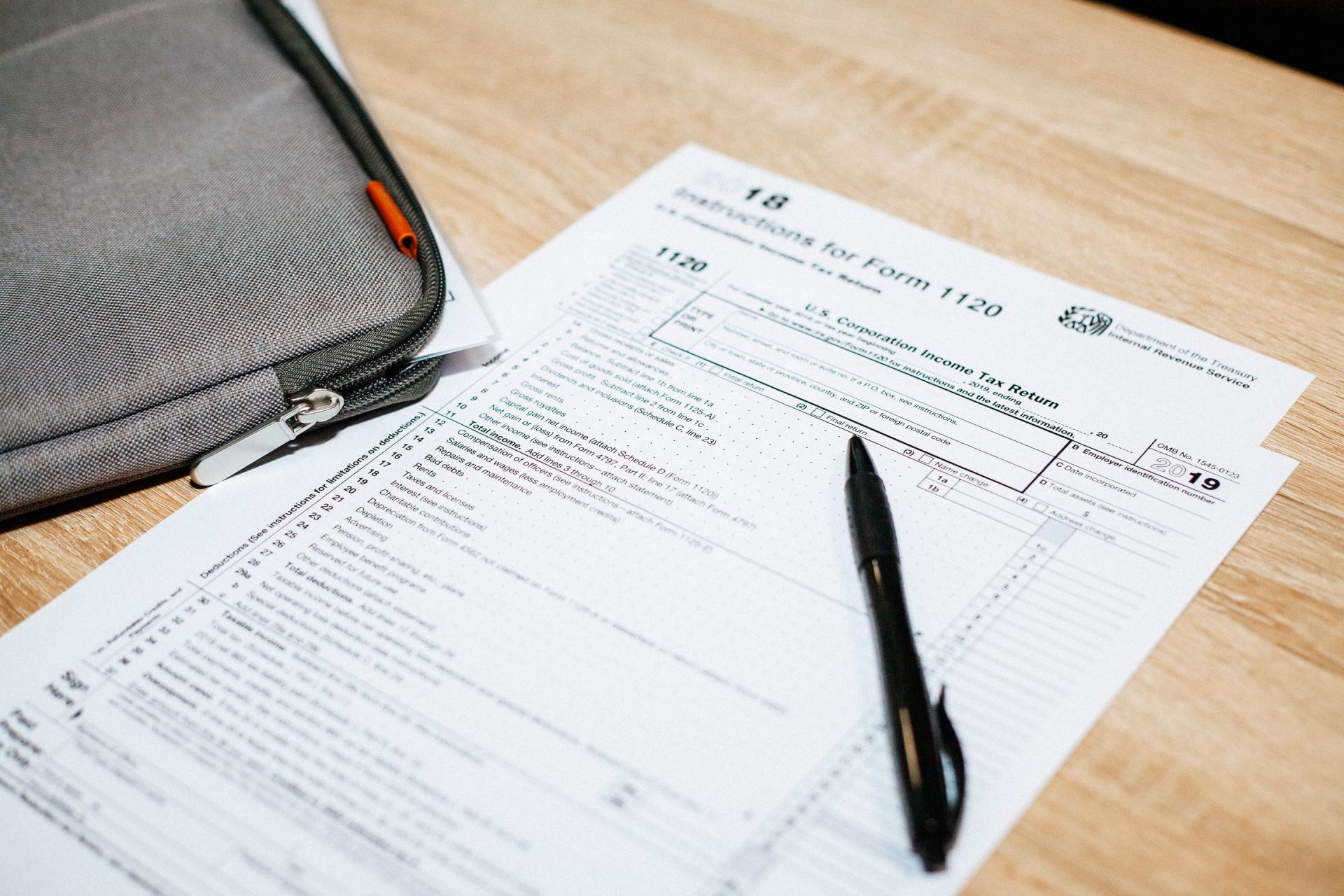

Corporate income declaration

The annual corporate income tax return form for Singapore companies is Form C or CS. The deadline is November 30 after 2021.